38+ covered interest arbitrage calculator

Covered in this scenario means it is hedged by a forward contract. The most common type is covered interest rate arbitrage which occurs when the exchange rate risk is hedged with a forward contract.

Pdf Mcgraw Hill Int Ational Edition Jamv Pelillos Academia Edu

Assuming this is the overnight swap rate the total interest would be.

. Web An arbitrageur executes a covered interest arbitrage strategy by exchanging domestic currency for foreign currency at the current spot exchange rate then investing the foreign currency at the foreign interest rate. The expiry date of the forward contract should be similar to the maturity of the foreign investment. If you enter the Odds for any two-way or three-way market in the Arbitrage Calculator above it will work out if there is an arbitrage.

Arbitrage basically means taking advantage of difference in spot rates of the same asset to make profit. Web What is Covered Interest Rate Arbitrage. Web Covered interest arbitrage is a strategy in which an investor uses a forward contract to hedge against exchange rate risk.

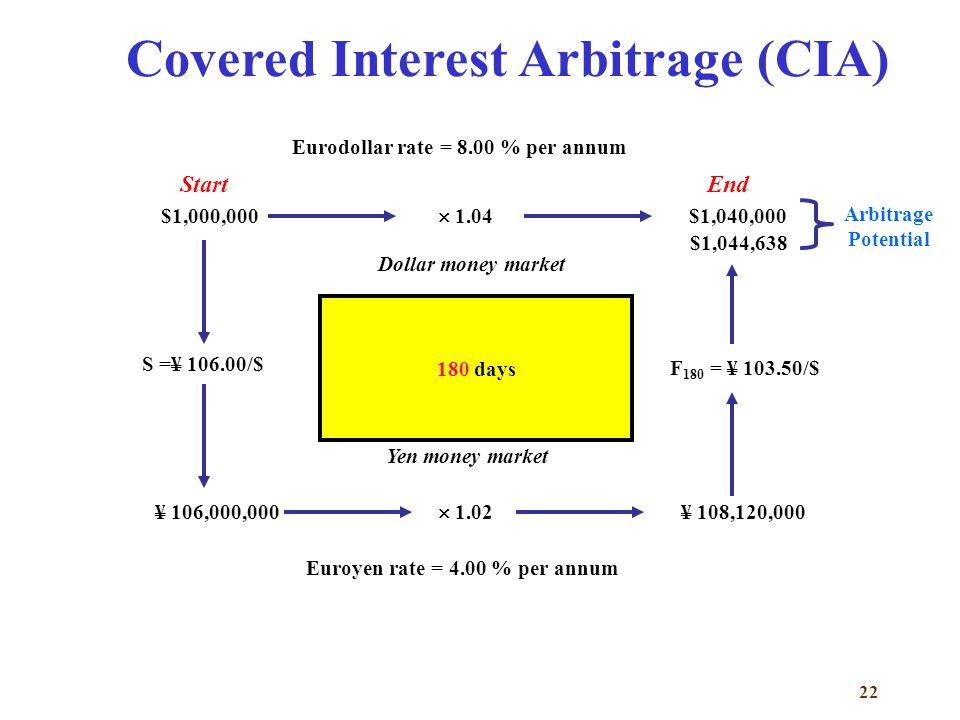

Below is a simplified covered interest rate arbitrage example excluding compounded interest transaction costs and taxes to illustrate the principle behind this strategy. It involves placing proportional bets on every possible outcome of an event with different bookmakers so regardless of what happens you will make a profit. Calculate the cost of funds interest paid for borrowing US at the Eurodollar rate of 8 per annum or 4 per 180 days with the principal and interest then totaling 1040000.

It establishes the fact that there is no opportunity for arbitrage using forward contracts which are often used to make loose profits by exploiting the difference in. The arbitrage calculator tells you if there is an arb betting opportunity and recommends how much should be staked on each selection. Web This calculator will compute the profit associated with an arbitrage transaction for a currency exchange given the amount borrowed of currency A the borrowing rate for currency A the lending rate for currency B the duration of the transaction in days and the exchange rate between currencies A and B.

Lets understand what it is by. If AUD interest rises to 4 in 6 months the differential is then 388. Web Arbitrage betting is a risk-free approach to betting that guarantees a profit.

Web A Covered Interest Arbitrage Example. Web Corporate Finance Institute FMVA CBCA CMSA BIDA. 1000 x ½ x 338 ½ x 388 36 AUD Exchange 1000 x 829 830 -100 yen Total profit in 12 months 36 AUD 100 yen.

First of all Covered Interest Rate Arbitrage is a forward derivative based investment strategy. Web Currency Arbitrage with Changing Interest Rates. Web THE ARBITRAGE CALCULATOR Not every betting market provides punters with an opportunity to make an arb bet and on most events the odds on opposing outcomes wont be equal.

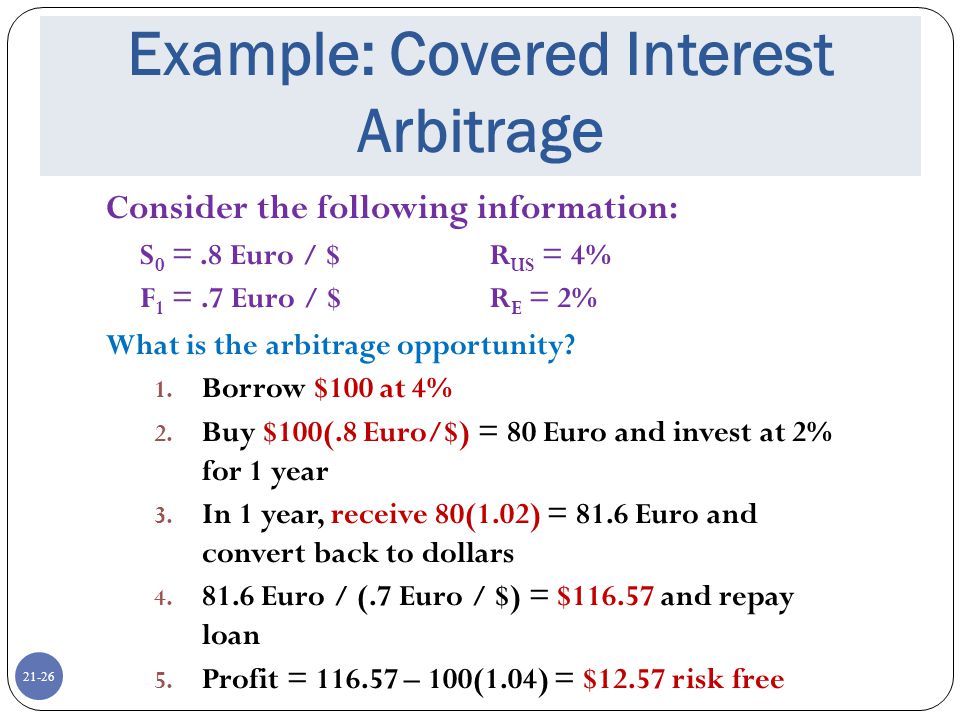

Assume you have 10000. Web Covered Interest Arbitrage Example To minimize this currency risk in a covered interest arbitrage an investor executes a usual interest arbitrage and buys a forward contract. On Sportsbook Z the Knicks are paying -125 to win while on Sportsbook Y the.

Web Carbon Collective March 24 2021. Web Covered interest rate parity says that investment in a foreign instrument that is completely hedged against exchange rate risk will have the same rate of return as an identical domestic instrument therefore this implies that the forward exchange rate can be determined depending upon the interest rate earned on the domestic and the foreign investment and. This example will take you through two of the main strategies of betting on arbitrage.

There are many different strategies and methods to bet on Arbitrage Bets. Web Interest rate arbitrage is used to capitalize on the difference between currencies for investors depending on a countrys economic health. Web The interest rate differential was 35 012338.

Arbitragers take advantage of interest rate. Web Arbitrage Betting Strategies. You have 100 and the New York Knicks are playing against the Boston Celtics.

Covered interest rate arbitrage is the practice of using favorable. Explain give example of uncovered interest arbitrage. Simultaneously the arbitrageur negotiates a forward contract to sell the amount of the future value of the foreign investment at a delivery date.

The US interest rate is 175. The carry trade is a form that involves borrowing capital from a country. Interest rate parity IRP is a concept which states that the interest rate differential between two countries is the same as the differential between the forwarding exchange rate and the spot exchange rate.

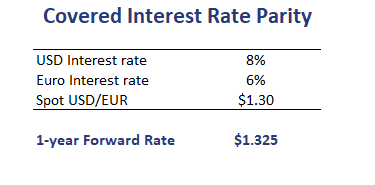

Web Covered interest rate parity CIRP is a theoretical financial condition that defines the relationship between interest rates and the spot and forward currency rates of two countries. Below is a covered interest rate arbitrage example. Forward exchange rates reflect interest rate differentials between two currencies.

Put simply the interest rate parity suggests a relationship between interest rates spot exchange. The profit from CIA is 1044638 - 1040000 4638. Web Interest Rate Parity Formula with Calculator Interest Rate Parity Interest Rate Parity Calculator Click Here or Scroll Down The formula for interest rate parity shown above is used to illustrate equilibrium based on the interest rate parity theory.

Apartment Budget Etsy Singapore

Covered Interest Arbitrage Youtube

Best Sports Betting Sites Bet On Sports In Ireand Casinoble 2023

Covered Interest Rate Parity Breaking Down Finance

Kalidas Pdf Derivative Finance Stocks

Octafx Review Forexbroker Ae

International Parity Conditions Ppt Download

Ppt I Nternational C Orporate F Inance Chapter 21 Powerpoint Presentation Id 472982

International Parity Conditions Ppt Download

Oklahoma Vs Florida State Odds Picks Predictions College Football Can Favorite Cover In Cheez It Bowl

Octafx Review Forexbroker Ae

Latitude 38 Jan 2005 By Latitude 38 Media Llc Issuu

How Did They Do It Real Estate Podcast Addict

Covered Interest Arbitrage Youtube

Apartment Budget Etsy Singapore

Arbitrage In Fx Markets Triangular Arbitrage Irp Ppt Download

International Corporate Finance Ppt Video Online Download